15+ Irs Letter 96C

Learn more about letter 96C wherefore you received it and how to handle it with help from the tax experts in HR Block. Web Receive an REVENUE 96C letter.

Irs Letter 324c Fill And Sign Printable Template Online

We Help Taxpayers Get Relief From IRS Back Taxes.

. Learn more regarding letter 96C wherefore you received it and how to handgrip information with help from the tax experts at HR Block. Web IRS Notice CP72 tells you that the IRS is accusing you of taking a frivolous position on your tax return. Web John Stancil Amended returns Form 1040X are manually processed by the IRS.

Web Answer A Question Unanswered Tax Questions I received a Letter 96c today from the IRS. For any number of reasons there is currently a large volume of amended returns being filed. I even paid the tax I owned online.

Web Receive an IRS 96C letter. Ad We Help Get Taxpayers Relief From Owed IRS Back Taxes. But if you follow the Prep Steps you can get.

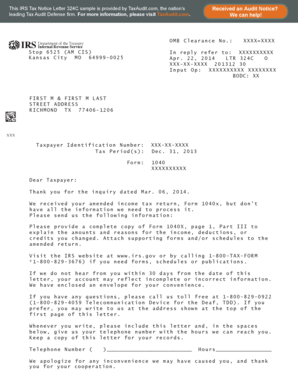

The letter said Dear taxpayer thank you for your correspondence. L TR 96C 201712 30 00000348 BODC. Learn more about letter 96C why you received it and how until handle it with help from the irs experts at HR Block.

The IRS uses Letter 96C to ask you for a response. They have a balance due. Web I received a letter from IRS LTR 96C to request me to refile my tax return since they did not receive my tax return for 2021.

It should have read May 18 2018. Read the letter carefully to determine what response is required. I filed an amended return back in April I had forgotten a form from my college and the IRS recently processed it.

The new notice you just received does not extend the 150 days. Web I got a letter 96c from IRS. My guess is the letter is a late acknowledgement that the.

They are due a larger or smaller. You will receive your refund in 8 weeks provided you owe no other taxes. 1040 31 2017 18 2017.

It said they did not receive my file tax of stated year and ask me to refile. Ad See If You Qualify For IRS Fresh Start Program. You should contact the IRS at 1-800.

They sent Letter 96C. Free Case Review Begin Online. It may be used to inform you that the IRS is doing nothing or to ask you for a response.

But after I checked the IRS website with my login information they got all my. Web IRS Notice Letter 96C. Web The IRS uses letter 96C as an acknowledgement or to request a response.

Therefore this is a dangerous letter to receive because the IRS is allowed to. Estimate How Much You Could Potentially Save In Just a Matter of Minutes. Based on your comments.

Web The IRS uses Letter 96C for correspondence of general information. Web IRS Tax Tip 2021-52 April 19 2021 The IRS mails letters or notices to taxpayers for a variety of reasons including if. Web You have 150 days for deficiency notices sent outside the US.

Tips for next year Consider filing. Web CP76 tells you we are allowing your Earned Income Credit as claimed on your tax return. Web Respond to Letter 681C.

Web The IRS got the year wrong on this form letter. Web IRS Tax Tip 2022-141 September 14 2022 When the IRS needs to ask a question about a taxpayers tax return notify them about a change to their account or request a payment. Web IRS Letter 96C Confusion.

Web Receive into IRS 96C letter. This is a very general letter and will likely not assist you in reducing or eliminating your IRS problem. Web In this letter the IRS reminds the taxpayer to make sure that payments continue on schedule or the IRS may cancel the installment agreement.

Irs Letter 96c Acknowledgement Letter H R Block

Carta 96c Informacion General Taxhelplaw

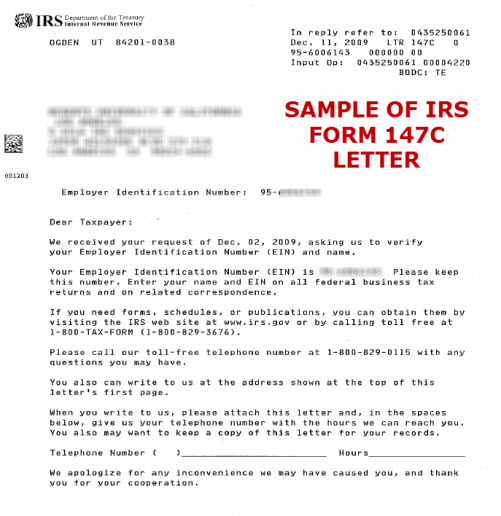

How Can I Get A Copy Of My Ein Verification Letter 147c From The Irs The Accountants For Creatives

:max_bytes(150000):strip_icc()/1099-C-69a52b42698048d68609c2c79946530d.jpg)

Form 1099 C Cancellation Of Debt Definition And How To File

Your New 501 C 3 Nonprofit 6 Steps For Form 1023 Approval Crowd101

Public Auction Sale No 21 The Sebel Surry Hills

S 1

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Congress Introduces Corporate Tax Transparency Legislation To Support Informed Investor Decisions The Fact Coalition

3 21 3 Individual Income Tax Returns Internal Revenue Service

:max_bytes(150000):strip_icc()/1099-A-0151e1f82f624920b802b26d693d47f6.jpg)

Form 1099 A Acquisition Or Abandonment Of Secured Property

Has Anyone Got Their Refund While Still Getting This Message Day 96 Counting R Irs

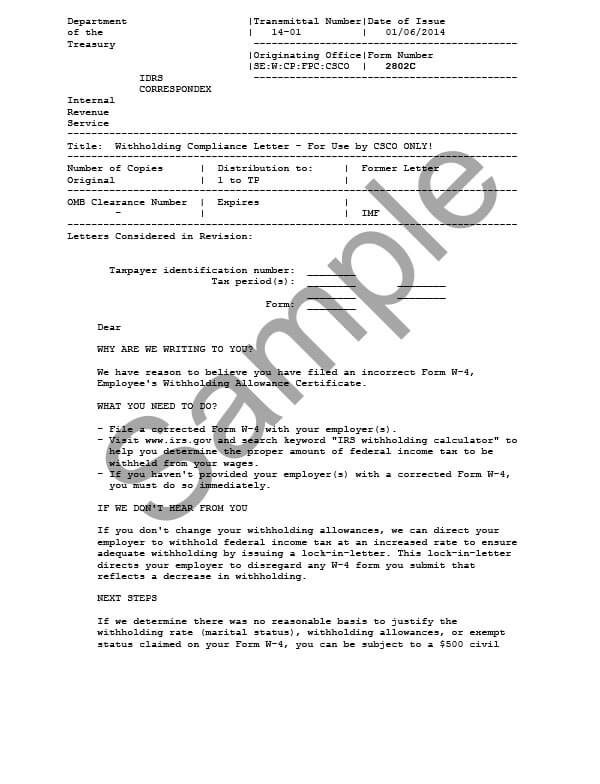

Irs Letter 2802c Tax Defense Network

Understanding Your Irs Letter 6419 Advance Child Tax Credit Payments Get It Back

How To Obtain A 147c From The Irs Brand S Help Desk

:max_bytes(150000):strip_icc()/form-1099-c-understanding-your-1099-c-form-4782275_final-9a33850e37ad4d54839284865d5b507b.png)

Form 1099 C Cancellation Of Debt Definition And How To File

Irs Notice Letter 96c Understanding Irs Notice Cp 96c Irs Is Asking For A Response